Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020. B Multiple Choices Theory 2 would result in multiple 12.

7 Tips To File Malaysian Income Tax For Beginners

Cantonal and communal CITs are added to federal CIT resulting in an overall effective tax rate between 119 and 216 depending on the companys location of corporate residence in Switzerland.

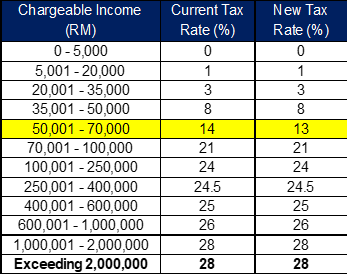

. Thus the government has agreed to lower the rate for personal tax rates 2021 income tax 2021 by one percentage point for those earning taxable wages from RM50001 to RM70000 which is expected to benefit 1. Tax is charged on profits for the. True They are exempt from income tax.

50 lakhs and Rs. Top Income Tax Articles. 1 This Act may be cited as the Income Tax Act 1967.

Guyana Republic of India Jamaica Republic of Kenya Kingdom of Lesotho Republic of Malawi Malaysia Malta Mauritius Republic of Nauru New Zealand Federal Republic of Nigeria Sierra Leone Republic of Singapore. Income up to INR 3 lakhs No tax. Income between INR 5 lakhs-10 lakhs.

There are four main types of national internal revenue taxes. Income Tax Act 1959. INDEPENDENT STATE OF PAPUA NEW GUINEA.

Income indirect value-added and percentage taxes excise and documentary stamp taxes all of which are administered by the Bureau of Internal Revenue. May 02 2019 at 238 pm. Malaysia has a withholding tax or Withholding Tax WHT.

LHDN must be. 10 of the income tax where the aggregate income is between Rs. Tajikistan Last reviewed 14 February 2022.

On average high-income countries have tax revenue as a percentage of GDP of around 22 compared to 18 in middle-income countries and 14 in low-income countries. Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back. Incomes up to Rs 25 lakhs are not taxed upon income between the values 25 lakhs to 5 lakhs are taxed 10 5 to 10 lakhs 20 and above 10 lakhs 30.

Income between INR 3 lakhs-INR 5 lakhs. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

Income more than 10 lakhs. The freelance calculate income tax shows the values as per these tax rates only. Taiwan Last reviewed 11 March 2022 20.

B answers hence inconsistent with 13. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. The CIT rate is 30 for large companies ie.

Final tax capital gains tax or regular income tax Multiple Choices Theory 1 6. Companies with gross turnover greater than NGN 100 million assessed on a preceding year basis ie. 15 of the income tax where the aggregate income is beyond Rs.

Resident companies are liable to corporate income tax CIT on their worldwide income while non-residents are subject to CIT on their Nigeria-source income. In high-income countries the highest tax-to-GDP ratio is in Denmark at 47 and the lowest is in Kuwait at 08 reflecting low taxes from strong oil revenues. At the national level taxes are imposed and collected pursuant to the National Internal Revenue Code the Tariff and Customs Code and several special laws.

Income Tax Act 1959 No. What are the Income Tax Taxation Slabs The same taxation slabs apply to the freelancing individuals as well. As a result of tax reform the percentage limit for charitable cash donations to public charities increased from 50 to 60 in 2018 and will.

85 on profit after tax 783 on profit before tax. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. You dont actually pay the full percentage value of the tax bracket you fall under and thats good 0.

Do i declare in Malaysia in which may required to pay tax in malaysia. Those who make payments payers in Malaysia withhold a certain percentage of income earned by non-residents payees. Malaysia Personal Income Tax Guide 2021 YA 2020.

Malaysia Budget 2021 Personal Income Tax Goodies

How To Calculate Foreigner S Income Tax In China China Admissions

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Individual Income Tax In Malaysia For Expatriates

Malaysian Tax Issues For Expats Activpayroll

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

10 Things To Know For Filing Income Tax In 2019 Mypf My

Malaysia Personal Income Tax Guide 2017 Ringgitplus Com

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Tax Guide For Expats In Malaysia Expatgo

Malaysia Income Tax Guide 2016 Ringgitplus Com

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Cukai Pendapatan How To File Income Tax In Malaysia

Budget Highlight 2021 Taxletter 26 Anc Group

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook